Case study

Know your customer

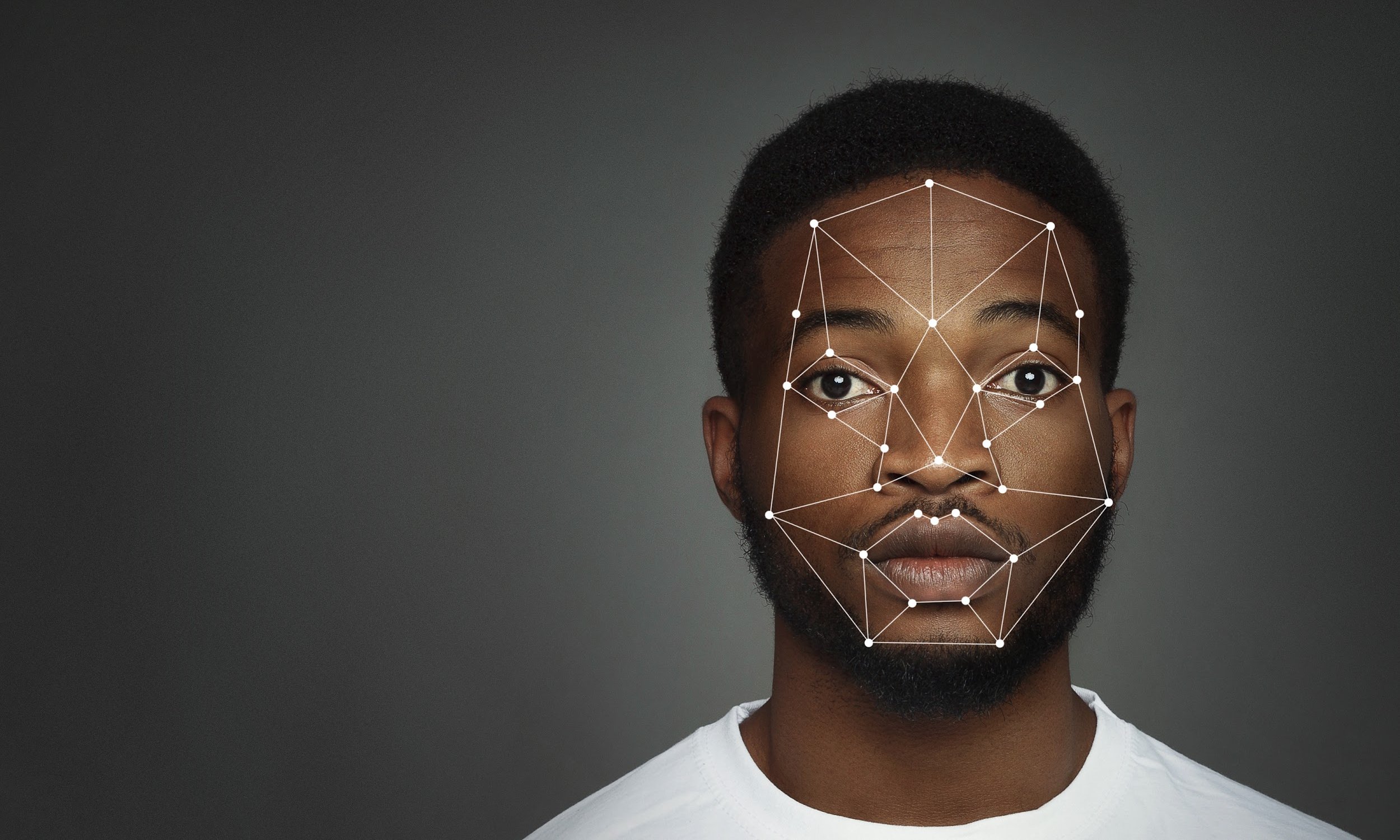

Accurate and secure face-to-face verification, online.

Financial Services Company

Consulting Services

Automation, digitalisation and digital experience.

Framework

Design thinking and market analysis.

Challenge

A financial services company with a suite of traditional and digital products, and a strong reputation as a safe and reliable company was facing a high increase in identity theft and fraud cases.

Their digital transformation efforts to retooling their company, digitise their services and become a digital-first finance company were being derailed by the slow adoption of fearful customers.

This presented a challenge of how to identify, verify, and authenticate customers quickly and safely without exposing them to compliance risk and operational risk. They turned to us to help them.

Numbers at a glance

0

Reported fraud cases.

20

Seconds to identify a customer, wherever they are.

70%

Identity verification cost reduction.

Solution

After engaging their leadership and interviewing their staff, we learned that what’s important to them was to empower their customers to interact less with an agent. However, their processes were manual, lengthy, and costly.

Our focus was to support their plans of digitalising their company by securing, automating, and reducing the cost of their identity verification process while mitigating their compliance and operational risk.

We recommended a digital solution that uses facial biometrics to identify, verify, and authenticate their customers remotely to ensure that the digital ID and real ID are the same. The solution also uses live video streaming to record the identity verification process in real-time to eliminate fraud.

Result

Our recommended solution would digitise their identification process holistically. It would provide a safe, frictionless, and convenient customer experience on the front end, and automate the back end by eliminating manual and repetitive steps.

This will reduce the company’s identification costs by more than 70%, the number of consultants it takes to verify a customer from three to none, and the amount of time it takes from one day to just 20 seconds.

The digital solution meets the Know Your Customer and Anti Money Laundering regulations, would increase their security, improve their privacy, and strengthen trust and relationships with their customers.